Experience the new beauty’s world editor’s choice

Harmay’s World is a registered trademark of HARMAY, Inc. All rights reserved ©

Topic

New Store Opening

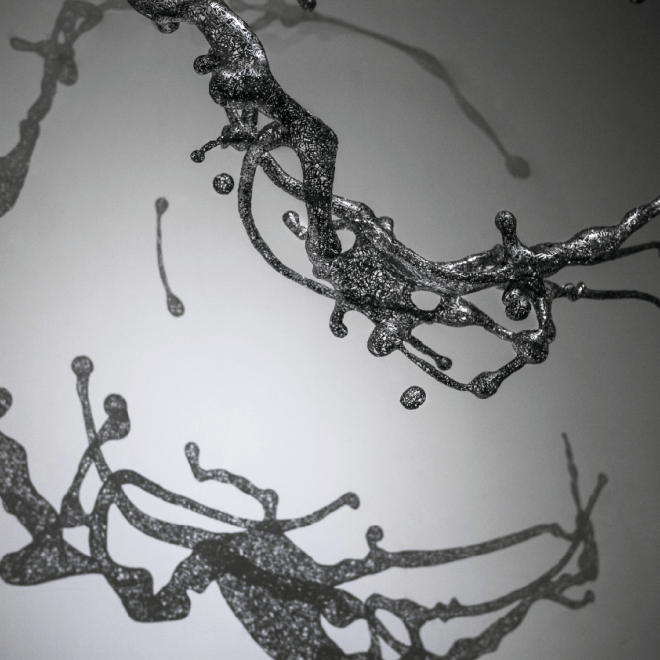

Chongqing, Explore the "Cave Factory" of HARMAY

HARMAY Fashion Show

Work, Live, Pose. A fashion show just staged in HARMAY’s “office”. The office is a testing ground for creation. The infinite imagination inspired by the brainstorming is here step by step into reality.

Creators for Eras

Why we always wait for the next festival. Humans use scales to measure the passage of time, and then give certain scales special meaning.

Be the creative now

#BeautyandLifes

News